The Benefits of Real Estate Ownership

Real estate has emerged as one of the most attractive options for asset diversification and reallocation. By adding real estate to a balanced portfolio, investors benefit from:

-

Reduced vulnerability to economic cycles

-

Yield steady income

-

The potential for high risk adjusted returns and capital growth

-

Tax structuring and deferral benefits

-

A likely hedge against inflation and excessive volatility, and a defense against recession

-

A low correlation coefficient with the equity and bond markets helping to hedge overall portfolio returns

Nonetheless access to direct real estate has historically been limited to ultra-affluent or institutional investors requiring:

-

A critical mass of capital

-

Highly specialized skills

-

Local market knowledge and relationships

-

A large dedicated infrastructure

Institutional Experience for Individual Investors

Because of the attributes listed above most institutional investors include real estate as a core component of their portfolio allocation.

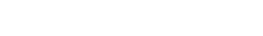

Typical Pension Fund Portfolio Allocation Has Direct Real Estate and Alternatives at Approximately 28%

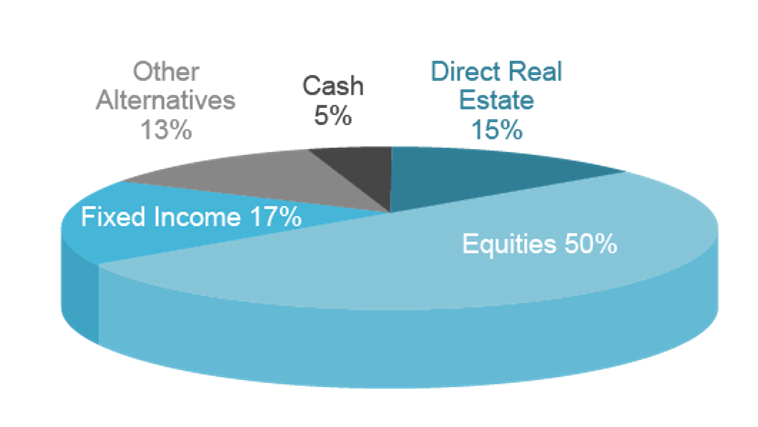

Individual Investors have little exposure (5%) to direct real estate and alternative investments compared to US. Endowments (52%) and US Pensions (28%)

Combined Direct Real Estate and Alternative Investment Exposure

Our Solution for Individual Investors

Valorem allows individual investors to benefit from the many attributes of real estate investing that were formally unavailable to most private investors.

-

Low minimum investments to participate in a diversified pool of commercial real estate

-

Fee levels typical for institutional investors

-

Institutional quality reporting and management

-

Market expertise, experience and relationships

-

Benefit from the low correlation direct real estate ownership has with other traditional asset classes and help improve overall investment returns on a balanced portfolio