Our Approach

Capitalize On Our Experience

The principals of Valorem bring a wide range of experience to the venture with over 150 years of combined experience in real estate acquisition, management, financing, and development. In addition to investment banking, distressed asset investing, venture capital, fundraising and business strategy. The principals have had leading roles in the raising of capital and investment of capital in over $5 billion of transactions.

Guiding Principles

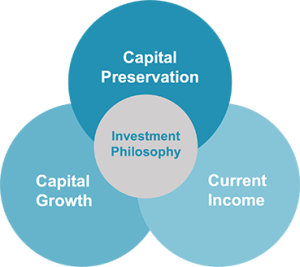

Investment Philosophy

Valorem’s Investment Philosophy is founded on the application of three fundamental tenets:

Disciplined Approach

-

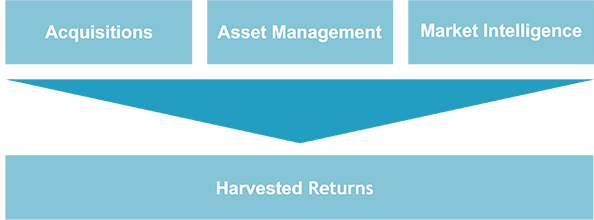

Valorem is skilled in all aspects of real estate investment, from the acquisition process to ongoing asset management, including the use of market intelligence and capital markets expertise to harvest value and optimize return

-

The successful execution of all these disciplines is critical to achieving consistent performance in the real estate sector over time

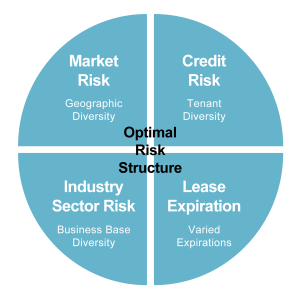

Risk Mitigation

- When creating portfolio for our investment initiatives, we are careful to construct portfolios that reflect the concept of “Dynamic Diversity” in order to effectively address issues of geographic market, credit, industry sector and lease term risk

- The strict adherence to these principals is critical to minimizing and managing risk in an investment and an overall portfolio

Investment Philosophy

Strategies

01.

Medical Office

We target institutional quality office buildings in high demand neighborhoods that either have an existing medical use or could be adapted to cater to a medical use.

Medical Office Key Attributes:

- Greater retention ratios than general office tenants

- Requires greater capital to build out their space

- Requires greater parking demands with limited supply in most areas

- Current consolidation in industry has created a demand surge

- Proximity to hospital and healthcare facilities

02.

Boutique Office

We focus on buildings in high demand areas that have the ability to cater to smaller tenants whose office locations are primarily determined by convenience and location.

Boutique Office Attributes:

- Well located institutional quality assets

- Located within major metropolitan and in adjacent to affluent submarkets

- Submarkets with strong barriers to entry

- Buildings that cater to or could be easily converted to

smaller tenants

03.

Multifamily

Valorem targets multifamily buildings that need improvement through renovation, mark-to-market of rents, or other operational considerations.

Key Multifamily Attributes

- Take advantage of the rise in rental housing.

- Target underperforming assets in strong markets “the worst

building on the best block” - Apply institutional ownership and management to underutilized assets.

- Target properties in close proximity to area demand generators.

04.

Special Situations

Take advantage of anomalies in the marketplace by purchasing distressed assets, or providing creative structured investments on an attractive risk adjusted basis.

Special Situations Attributes

- Current interest rate environment causing refinancing shortfalls.

- Quickly access smaller profitable transactions that would

typically be “below the radar” of large financial institutions and mezzanine lenders. - Shorter hold periods have more liquidity than traditional real estate funds.

- Attractive risk adjusted returns.

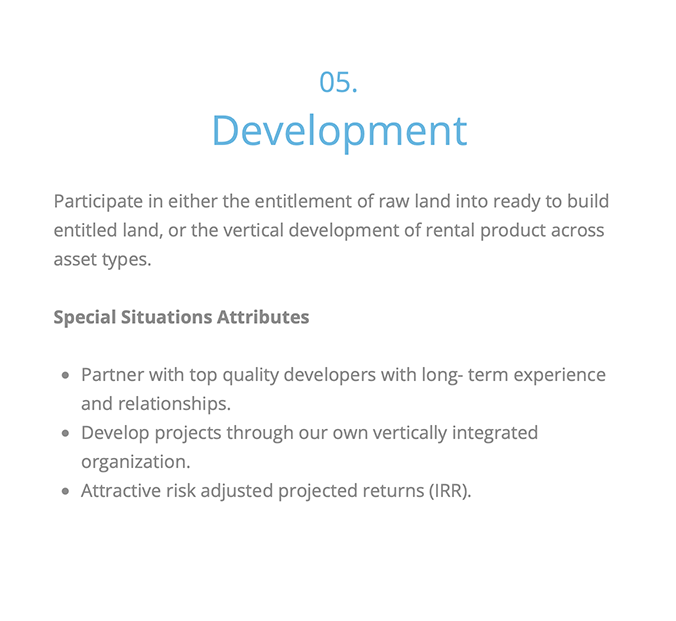

05.

Development

Participate in either the entitlement of raw land into ready to build entitled land, or the vertical development of rental product across asset types.

Special Situations Attributes

- Partner with top quality developers with long- term experience and relationships.

- Develop projects through our own vertically integrated organization.

- Attractive risk adjusted projected returns (IRR).